आज ही PU Xtrader Challenge में शामिल हों।

सिम्युलेटेड कैपिटल के साथ व्यापार करें और हमारे ट्रेडर मूल्यांकन उत्तीर्ण करने के बाद वास्तविक लाभ कमाएं।

आज ही PU Xtrader Challenge में शामिल हों।

सिम्युलेटेड कैपिटल के साथ व्यापार करें और हमारे ट्रेडर मूल्यांकन उत्तीर्ण करने के बाद वास्तविक लाभ कमाएं।

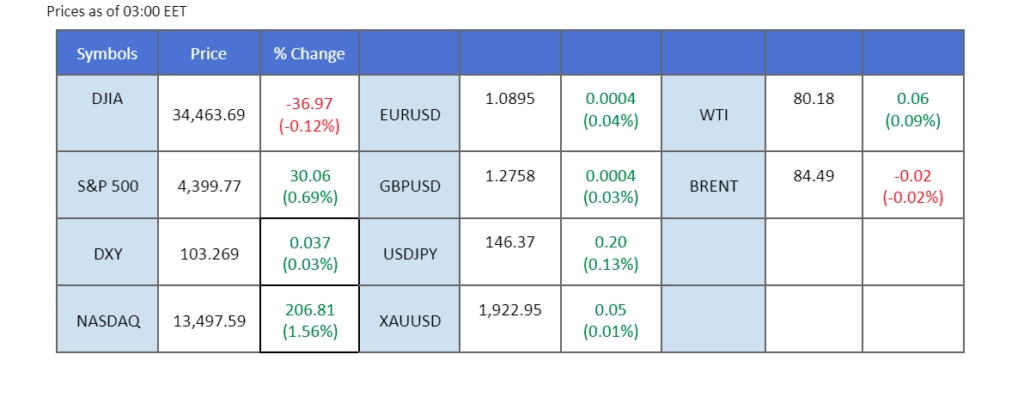

The Chinese stock market remains in a downward trend, primarily influenced by challenges within the property sector and limited Chinese economic stimulus efforts. The recent bullish oil prices have also hindered the much-worried Chinese economy, as the hope for China oil demand is fading. Amidst these developments, the New Zealand dollar has experienced a sustained decline against the US dollar for ten consecutive days. This persistent slide can be attributed to China’s ongoing struggles in stimulating its economy, putting pressure on the New Zealand dollar’s ability to recover. Simultaneously, the US long-term bond yields have reached their highest point since 2007. This ascent occurs just ahead of the Jackson Hole Economic Symposium. Meanwhile, the dollar index remains steady, poised for potential movement following Jerome Powell’s upcoming speech scheduled for Thursday.

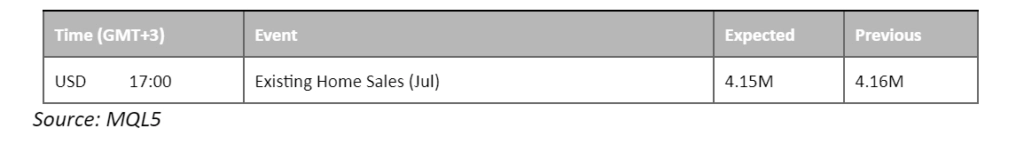

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US dollar’s rally took a breather, ending its impressive five-week climb. Investors locked in profits as the currency hit key resistance levels ahead of the upcoming Federal Reserve symposium in Jackson Hole, Wyoming. Recent robust economic indicators and hawkish signals from the FOMC minutes had fuelled optimism about sustained higher interest rates, yet uncertainty looms before the pivotal meeting. All eyes now turn to Federal Reserve Chair Jerome Powell’s remarks for guidance on the next market moves.

The dollar index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 50, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 103.60, 104.20

Support level: 102.75, 102.15

A recent crisis in China’s economy prompted wary investors to seek refuge in gold. Despite the People’s Bank of China trimming its one-year loan prime rate by 10 basis points, scepticism persists. The move is seen as insufficient to stabilise China’s economic momentum. With eyes firmly fixed on China’s uncertain economic landscape, gold’s safe-haven allure remains strong.

Gold prices are trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 1900.00, 1930.00

Support level: 1880.00, 1860.00

The euro has successfully held its support level and is presently trading above 1.0900 against the US dollar. Concurrently, the dollar index maintains its position, exhibiting a slight softening as it approaches the Jackson Hole Economic Symposium. Market participants eagerly await Jerome Powell’s speech during the event, aiming to glean insights into the Federal Reserve’s prospective monetary policy direction. Meanwhile, the US 10-year Treasury bonds yield has surged, reaching levels unseen since 2007. This upsurge is anticipated to bolster the dollar’s strength, aligning with the trajectory of the elevated Treasury yields.

The pair has gained more than 0.2% from its short-term support level at 1.0860. The RSI has rebounded from the lower region while the MACD has crossed at the bottom, suggesting a trend reversal signal for the pair.

Resistance level: 1.0924, 1.0990

Support level: 1.0848, 1.0760

The interest rate gap between the United States and the United Kingdom has diminished, mainly due to expectations of ongoing rate hikes by the Bank of England (BoE) due to the country’s elevated inflation rates. Furthermore, the British Pound (Sterling) has capitalised on a weakened US dollar in the previous session, as investors shifted their attention towards the equity market, particularly noting the positive performance of certain technology stocks. However, the recent surge in the yield of the US 10-year Treasury bonds, reaching levels not observed since 2007, suggests that the US dollar is likely to strengthen in the near future.

The Sterling has broken above its downtrend resistance level, suggesting a bullish momentum is forming. The view is also supported by the indicators where the RSI moves toward the overbought zone while the MACD is poised above the zero line.

Resistance level: 1.2780, 1.2870

Support level: 1.2640, 1.2550

The Kiwi, has recently experienced a 10-day consecutive decline against the dollar. This decline has amounted to over a 7% drop since its peak in mid-July. The Kiwi’s inability to gain strength can be attributed to China’s sluggish economic recovery and ongoing economic challenges. Given that China holds a significant role as New Zealand’s largest trading partner, its struggles have impacted the Kiwi’s upward momentum. Anticipation surrounds New Zealand’s upcoming release of retail sales data scheduled for tomorrow. The consensus is that this data will show a contraction compared to the previous reading. This situation has led investors to speculate that the RBNZ might opt to continue the current interest rate pause. As a result of these factors, the Kiwi is facing a weakened position.

The Kiwi rebounded slightly against the dollar. The RSI has been climbing toward the overbought zone while the MACD is also moving toward the zero line from below, suggesting a trend reversal.

Resistance level: 0.5980, 0.6050

Support level: 0.5900, 0.5800

The Nasdaq advanced as Nvidia surged, buoyed by investor optimism ahead of its upcoming earnings report. Amidst a backdrop of strategic dip-buying spurred by a slight retracement in the US equity market the previous week, Nvidia outperformed, climbing 8.5%. The semiconductor leader led gains within the sector, propelled by HSBC’s upward revision of its price target for the stock to $780—a figure now the second highest on Wall Street.

Nasdaq is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 44, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory. .

Resistance level: 15315.00, 15935.00

Support level: 14330.00, 13645.00

Fragile risk sentiment continued to cast a shadow over global markets, driven by concerns about China’s property market. This unease weighed on high-risk assets like the Australian dollar, which faced further losses. With Australia looking to Chinese recovery for cues, market participants eagerly await economic updates from China for potential signals.

AUD/USD is trading lower while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 0.6465, 0.6600

Support level: 0.6385, 0.6285

Oil prices faced headwinds due to a grim economic outlook in China. As a crucial oil consumer, China’s lacklustre economic performance dimmed the appeal of the commodity. Nevertheless, supply-side factors lent support to prices, with substantial production cuts by Saudi Arabia and Russia bolstering oil’s resilience in the face of uncertainty.

Oil prices are trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 42, suggesting the commodity might extend its losses after breakout below the support level since the RSI stays below the midline.

Resistance level: 83.25, 87.25

Support level: 79.00, 76.90

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

नए पंजीकरण उपलब्ध नहीं हैं

हम इस समय नए पंजीकरण स्वीकार नहीं कर रहे हैं।

नए साइन अप उपलब्ध नहीं हैं, लेकिन मौजूदा उपयोगकर्ता अपनी चुनौतियों और ट्रेडिंग गतिविधियों को सामान्य रूप से जारी रख सकते हैं।