आज ही PU Xtrader Challenge में शामिल हों।

सिम्युलेटेड कैपिटल के साथ व्यापार करें और हमारे ट्रेडर मूल्यांकन उत्तीर्ण करने के बाद वास्तविक लाभ कमाएं।

आज ही PU Xtrader Challenge में शामिल हों।

सिम्युलेटेड कैपिटल के साथ व्यापार करें और हमारे ट्रेडर मूल्यांकन उत्तीर्ण करने के बाद वास्तविक लाभ कमाएं।

Amidst deepening tensions in the Middle East conflict, the market’s gaze remains fixated on evolving dynamics. Gold surged past its pivotal $2000 mark, propelled by the expansion of ground warfare. Concurrently, oil prices found a foothold above $83, with investors vigilant about potential supply disruptions from the region, a global oil supply cornerstone. This week, pivotal interest rate decisions loom from major central banks—Federal Reserve, Bank of England (BoE), and Bank of Japan (BoJ)—adding an anticipated layer of market volatility. Investors and analysts worldwide are closely watching these global events as they shape the financial landscape.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.0%) VS 25 bps (2%)

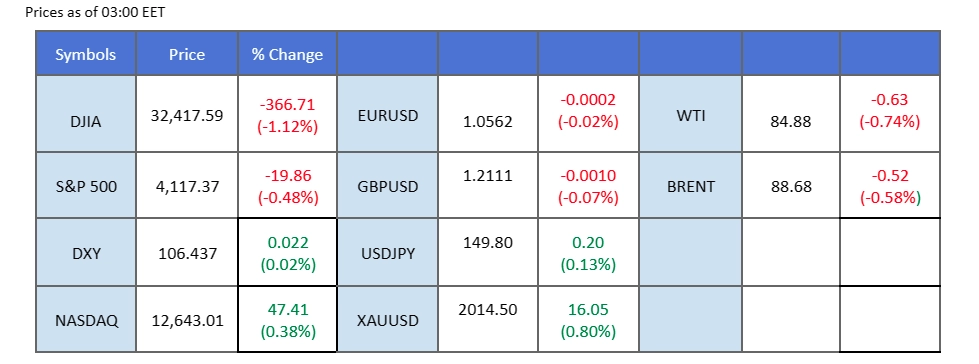

Source: MQL5

US Core PCE prices surged, marking the most significant increase in four months. This suggests that consumer spending in the United States is on the rise. However, the dollar’s response to the PCE data remained flat, as the actual reading closely aligned with market expectations. According to the Bureau of Economic Analysis report released on Friday, the US Core Personal Consumption Expenditures Price Index (PCE), which excludes volatile food and energy components, rose by 0.30% in September, in line with market predictions.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 57, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 106.70, 107.15

Support level: 105.60, 104.80

Ongoing geopolitical tensions in the Middle East have sparked increased demand for the safe-haven gold, propelling its price to reach the psychological level of $2000. According to Reuters, Israel signalled its intent to encircle Gaza’s main city on Sunday, releasing images of battle tanks along the Palestinian enclave’s western coast just 48 hours prior. This week, market volatility is expected to persist, with several high-impact catalysts set to influence trading, including the release of the Federal Reserve meeting minutes and Nonfarm Payrolls data.

Gold prices are trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level: 2025.00, 2080.00

Support level: 1980.00, 1895.00

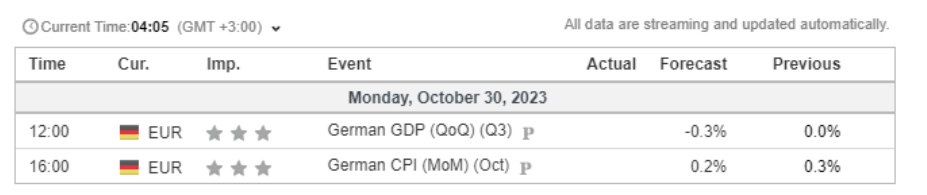

The euro maintained a flat trajectory following the European Central Bank’s decision to maintain interest rates, marking the end of its tightening monetary cycle. Investors should closely monitor German GDP and CPI data for potential trading signals.

EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.0675, 1.0795

Support level: 1.0530, 1.0335

The British Pound (GBP/USD) secured support above its critical liquidity zone near the 1.2090 level. Despite widespread market anticipation of the Federal Reserve maintaining its current interest rate amidst the escalating Middle East conflict, the US dollar remains robust due to geopolitical tensions. Simultaneously, concerns regarding the lacklustre economic performance in the UK have led to speculation about another round of rate pause from the Bank of England, adding to the cautious sentiment surrounding the Pound. Both central bank decisions, with the Fed on Wednesday and the Bank of England in the following days, are poised to influence Cable’s future trajectory significantly.

The Cable has found support above its liquidity zone, suggesting an easing in its bearish momentum. The RSI and the MACD both flowing sideways gave a neutral signal for the Cable.

Resistance level: 1.2300, 1.2565

Support level: 1.2060, 1.1830

Nasdaq experienced a slight increase, primarily driven by technical correction. However, the overall trend for tech-heavy indexes remains negative, burdened by a string of pessimistic earnings reports. Disappointments from major tech companies during the third-quarter earnings season, such as Alphabet (Google) and Tesla, led to a slump in their respective shares. The tech-heavy Nasdaq 100 Index has declined by 11% from its recent high. Adding to the uncertainties, Apple is set to release its earnings report later this week.

Nasdaq is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 32, suggesting the index might enter oversold territory.

Resistance level: 14610.00, 15780.00

Support level: 13725.00, 12690.00

The Japanese Yen (JPY/USD) returned to a crucial liquidity zone after a significant breakout last week. Focus intensifies on the upcoming Bank of Japan (BoJ) interest rate decision this Tuesday. The BoJ faces a challenging dilemma: maintaining the status quo risks a multi-decade low for the Yen, while policy adjustments may impact Japan’s inflation goals. High volatility is anticipated in the Yen pairs following the BoJ’s announcement.

USD/JPY is trading flat within its previous liquidity zone after its broke above its crucial resistance level at 150.00 level last Friday. The MACD and the RSI have declined, suggesting the bullish momentum has vanished.

Resistance level: 150.40, 151.50

Support level: 148.55, 147.50

The AUD/USD pair is challenging its long-term downtrend resistance, amid robust economic data and heightened Middle East tensions boosting the US dollar. Market focus shifts to China’s upcoming PMI reading, anticipated to surpass expectations. A strong figure could bolster the Aussie dollar against the resilient greenback this week.

AUD/USD is trading along its long-term downtrend resistance level, while breaking above the resistance level will signal a trend reversal for the pair. The RSI and the MACD have been inclining, suggesting a bullish momentum is forming.

Resistance level: 0.6395, 0.6510

Support level: 0.6300, 0.6205

Oil prices remained stagnant, hovering near a key support level. Investors are closely monitoring Middle East tensions for potential trading signals. While recent developments in the Middle East haven’t directly affected oil supplies, concerns persist about potential disruptions to exports from major crude-producing and Hamas-backing countries like Iran.

Oil prices are trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 49, suggesting the commodity might experience technical correction since the RSI stays below the midline.

Resistance level: 89.35, 94.00

Support level: 82.50, 78.15

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

नए पंजीकरण उपलब्ध नहीं हैं

हम इस समय नए पंजीकरण स्वीकार नहीं कर रहे हैं।

नए साइन अप उपलब्ध नहीं हैं, लेकिन मौजूदा उपयोगकर्ता अपनी चुनौतियों और ट्रेडिंग गतिविधियों को सामान्य रूप से जारी रख सकते हैं।