आज ही PU Xtrader Challenge में शामिल हों।

सिम्युलेटेड कैपिटल के साथ व्यापार करें और हमारे ट्रेडर मूल्यांकन उत्तीर्ण करने के बाद वास्तविक लाभ कमाएं।

आज ही PU Xtrader Challenge में शामिल हों।

सिम्युलेटेड कैपिटल के साथ व्यापार करें और हमारे ट्रेडर मूल्यांकन उत्तीर्ण करने के बाद वास्तविक लाभ कमाएं।

5 July 2023,06:35

Daily Market Analysis

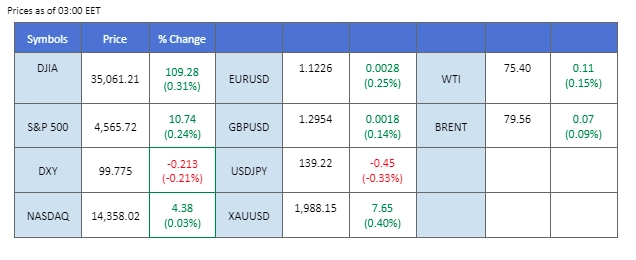

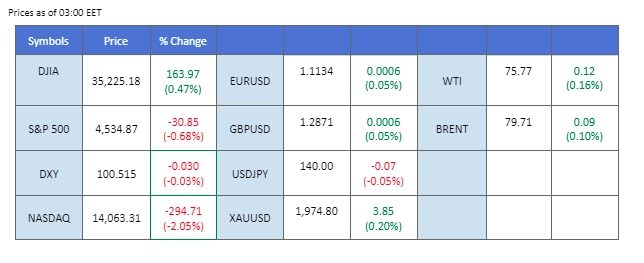

The market was surprised when the RBA decided to keep rates unchanged yesterday. The Australian central bank emphasized a data-dependent strategy and indicated potential future tightening if necessary. Oil prices slightly increased as Saudi Arabia unilaterally reduced production, with support from Russia and Algeria. Investors are eagerly awaiting China’s PMI data to gauge the future movement of oil prices. While the U.S. celebrated its Independence holiday, the market remained relatively calm last night. However, volatility is expected to pick up soon as the following days in the week are filled with crucial economic data, including the Non-Farm Payrolls (NFP) report on Friday.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (11%) VS 25 bps (89%)

The US Dollar continues to trade within a narrow range, with investors closely monitoring developments ahead of the release of the FOMC meeting minutes. Speculations are mounting that the Federal Reserve will maintain a hawkish stance, as Fed Chair Jerome Powell had previously signalled the likelihood of further rate hikes later this year.

The dollar index is trading flat while currently consolidating between the resistance level and support level. MACD has illustrated diminishing bearish momentum, while RSI is at 54, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 103.30, 103.90

Support level: 102.70, 101.95

Despite trading flat, the gold market maintains its positive trajectory as investors seek refuge from heightened market volatility. The intensive data and events lined up for the week have fueled a cautious sentiment, prompting market participants to turn to safe-haven assets. Moreover, escalating US-China tensions, stemming from China’s restrictions on key metals used in vital sectors like semiconductors and electric vehicles, have added to concerns about global supply chains.

Gold prices are trading flat while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 55, suggesting the commodity will extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1930.00, 1955.00

Support level: 1910.00, 1895.00

The euro continued to slide against the dollar despite the ECB policymakers striking a more hawkish tone last week. Investors are highly anticipating the FOMC meeting minutes that will be released later tonight to gauge the dollar strength before the NFP release on Friday. Notwithstanding the Hawkish statement from Jerome Powell in this semi-annual monetary policy testimony last month, a pessimistic PMI reading may hinder the U.S. central bank from raising the rate aggressively. Meanwhile, downbeat German data also put the ECB in a dilemma to impose a hawkish monetary policy.

EUR/USD price movement has been sluggish since mid-June, where a lower-high and a lower-low price pattern has formed. The RSI has been hovering in the lower region while the MACD failed to break above the zero line, suggesting the bearish momentum is still intact.

Resistance level: 1.0951, 1.1027

Support level: 1.0848, 1.079

The Sterling rallied up slightly while the U.S. celebrated their Independence holiday last night. The BoE has seen an increase in a rate hike as the inflation seems to continue to be high with the May CPI showed. Investors are early waiting for the UK PMI reading, which will be announced later today, to gauge the strength of the Sterling. At the same time, the FOMC meeting minutes as well as the ADP nonfarm employment data released the following day will also have an impact on the Cable.

The Cable broke above the downtrend resistance line, signalling a potential trend reversal. The RSI has been moving up after rebounding from the 30-level and the MACD has broken above the zero line suggesting a bullish momentum is forming.

Resistance level: 1.2775, 1.2840

Support level: 1.2633, 1.2542

The Australian dollar defied expectations by rallying against the US dollar, even after the Reserve Bank of Australia opted to keep its cash rate steady at 4.10%. Investors reassessed the central bank’s policy statement, considering the need for potential future tightening measures to address rising inflation. While inflation rates have moderated from their peak in December, the current level of 5.6% on an annual basis still exceeds the RBA’s targets.

AUD/USD is trading flat while currently near the support level. MACD has illustrated diminishing bullish momentum. However, RSI is at 54, suggesting the pair might rebound from the support level since the RSI stays above the midline.

Resistance level: 0.6725, 0.6785

Support level: 0.6675, 0.6625

With Wall Street closed for the 4th of July holiday, the global equity market finds itself consolidating within a narrow range. Traders and investors are patiently awaiting the upcoming economic data releases before committing to new positions. This period of consolidation sets the stage for potentially significant volatility once the crucial data points are unveiled, offering both opportunities and risks for market participants.

The Dow is trading higher following the prior breakout above the previous resistance levell. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the index might extend its gains

Resistance level: 34895.00, 35490.00

Support level: 34255.00, 33700.00

Oil traders find themselves caught between conflicting forces as the market grapples with supply cuts and a pessimistic demand outlook. Despite Saudi Arabia and Russia’s earlier commitment to substantial export reductions, oil prices continue to decline. Some investors are selling their oil positions in anticipation of weaker demand, should a global slowdown materialise. With several crucial economic data releases on the horizon, investors eagerly await signals that could shed light on the global economic landscape.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the commodity to extend its gains after successfully breakout since the RSI stays above the midline.

Resistance level: 71.10, 74.25

Support level: 67.25, 64.90

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

नए पंजीकरण उपलब्ध नहीं हैं

हम इस समय नए पंजीकरण स्वीकार नहीं कर रहे हैं।

नए साइन अप उपलब्ध नहीं हैं, लेकिन मौजूदा उपयोगकर्ता अपनी चुनौतियों और ट्रेडिंग गतिविधियों को सामान्य रूप से जारी रख सकते हैं।