आज ही PU Xtrader Challenge में शामिल हों।

सिम्युलेटेड कैपिटल के साथ व्यापार करें और हमारे ट्रेडर मूल्यांकन उत्तीर्ण करने के बाद वास्तविक लाभ कमाएं।

आज ही PU Xtrader Challenge में शामिल हों।

सिम्युलेटेड कैपिटल के साथ व्यापार करें और हमारे ट्रेडर मूल्यांकन उत्तीर्ण करने के बाद वास्तविक लाभ कमाएं।

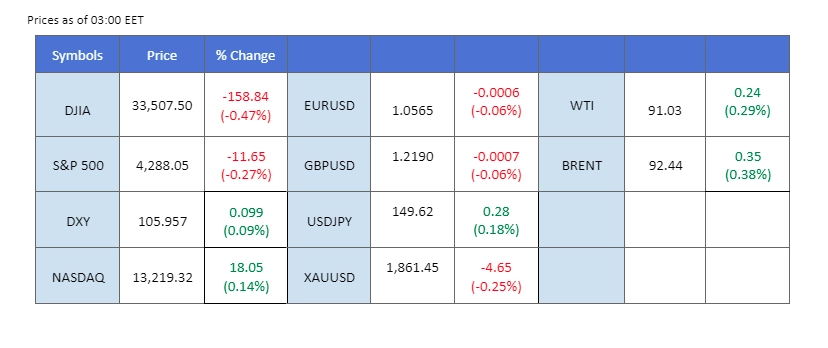

In a staunch show of strength, the dollar advances, driving the dollar index towards $107, bolstered by the Federal Reserve’s recent communication. The market consensus leans heavily towards the Fed maintaining elevated interest rates to combat persistent inflation. This dollar surge casts a shadow over commodities, with gold enduring seven consecutive sessions of decline and oil slipping below $90 this week. Simultaneously, the Japanese Yen defies the dominant dollar, with the USD/JPY pair firmly below $150. Investor speculation suggests potential policy adjustments from the Bank of Japan, buoyed by sustainable inflation rates surpassing the BoJ’s favourable threshold this year.

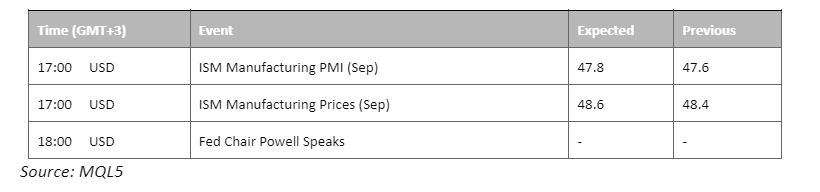

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (78.0%) VS 25 bps (22%)

US Treasury yields inched higher as investor confidence in the US economic outlook remained strong following the avoidance of a government shutdown. This optimism continued to fuel expectations of rate hikes by the Federal Reserve, contributing to the US Dollar’s ongoing bullish trend. According to the CME FedWatch Tool, traders now assign a 30% probability to a rate hike next month, a notable increase from the 18% probability observed just last week.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the index might enter overbought territory.

Resistance level: 107.20, 108.95

Support level: 105.45, 103.25

Gold continued its significant descent in the face of a strengthening US Dollar. Investors are advised to stay vigilant, keeping a watchful eye on critical economic data releases from the US, including ADP Nonfarm Employment Change, Nonfarm Payrolls, and the US Unemployment Rate, which may provide further trading signals.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 20, suggesting the commodity might enter oversold territory.

Resistance level: 1840.00, 1890.00

Support level: 1790.00, 1715.00

The Euro experienced a notable selloff following fresh indications of economic challenges in the Eurozone. Data revealed that Eurozone manufacturing activity remained deeply contracted, with Germany’s Manufacturing Purchasing Managers Index (PMI) coming in at 39.6, falling short of market expectations at 39.8. A reading below 50 signals contraction in the European region, underlining the economic headwinds faced by the Euro.

EUR/USD is trading lower while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 29, suggesting the pair might enter oversold territory.

Resistance level: 1.0610, 1.0795

Support level: 1.0445, 1.0205

The Japanese yen resiliently held its ground against the surging dollar as the dollar index edged closer to the $107 mark. The recent Hawkish stance articulated by the Fed propelled the dollar’s robust performance against other currencies, restraining the Japanese Yen’s potential rebound. Market speculation is rife, suggesting that Japanese authorities may consider intervening in the foreign exchange market to stabilise the Yen, especially as the USD/JPY pair nears the critical threshold at the 150 mark.

The USD/JPY pair continues to trade in an uptrend manner and the bullish momentum seems strong, with the MACD continuing to flow in the upper region while the RSI has been hovering near the overbought zone.

Resistance level: 150.75, 151.50

Support level: 149.30, 147.80

The formidable dollar maintains its grip, exerting pressure on the Australian dollar in anticipation of the pivotal RBA interest rate decision. The AUD/USD pair is currently at its lowest point since November of the previous year. Weakened PMI data from China, coupled with rate pauses from both the Fed and the BoE, have led market speculation to lean towards the RBA maintaining its current interest rate levels. Such a decision could further undermine the strength of the Aussie dollar.

AUD/USD broke below its crucial short-term support level at 0.6350, suggesting a solid bearish signal for the pair. The RSI and the MACD declined drastically, suggesting the bullish momentum has vanished.

Resistance level: 0.6370, 0.6430

Support level: 0.6288, 0.6175

The sell-off in Treasury bonds intensified, and US stocks faced losses as market participants processed the Federal Reserve’s commitment to maintaining high borrowing costs to combat inflation. Rising yields have traditionally dampened the appeal of the US equity market.

The Dow is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 34355.00, 34900.00

Support level: 33425.00, 32745.00

The Cable has remained within a downtrend channel throughout September, extending into October. Gloomy economic figures from the UK, encompassing Retail Sales and PMI readings, have impeded Sterling’s upward momentum. In contrast, the dollar is fueled by the Fed’s hawkish stance, potentially widening the interest rate differential between the two nations.

The GBP/USD pair continues to trade within the downtrend channel, adding that the RSI as well as the MACD showing that the pair is trading in bearish momentum, the Cable downtrend is expected to continue.

Resistance level: 1.2190, 1.2370

Support level:1.2040, 1.1937

The US Dollar reached a new 10-month high, which had a suppressing effect on dollar-denominated oil. On the horizon, investors will closely monitor developments within OPEC+, the alliance of 23 oil-producing nations, as it convenes this week. Sources within OPEC+ have indicated that production targets for November and December are unlikely to be adjusted.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 94.40, 101.00

Support level: 87.80, 79.65

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

नए पंजीकरण उपलब्ध नहीं हैं

हम इस समय नए पंजीकरण स्वीकार नहीं कर रहे हैं।

नए साइन अप उपलब्ध नहीं हैं, लेकिन मौजूदा उपयोगकर्ता अपनी चुनौतियों और ट्रेडिंग गतिविधियों को सामान्य रूप से जारी रख सकते हैं।